If you’re a car fanatic, you’ll know how tempting the idea of driving a brand-new vehicle can be. The shiny paint and that fresh car smell is hard to say no to. But for many people, the financial and practical downsides can far outweigh the excitement. Before you commit to either decision, it’s worth considering why a new car might not be the best choice for your wallet or your lifestyle. Let’s take a look at a few reasons why that could be the case for you.

Rapid Depreciation

Did you know that the moment you drive a new car off the lot, its value starts dropping? Most new vehicles lose around 20% to 30% of their value in the first year alone, which is pretty significant for such a short period. This rapid depreciation can make a new car a bad financial investment, especially when pre-owned options can offer similar reliability at a much lower price.

Higher Monthly Payments

It goes without saying that new cars typically come with a hefty price tag, and that means higher monthly payments if you’re financing the purchase. If you buy new instead of used, you could be looking at hundreds more each month for essentially the same function: getting from point A to point B.

Increased Insurance Costs

It makes sense that insurance for a new car is usually significantly more expensive than for a used one since new cars have a higher value and cost more to repair or replace in case of an accident. This higher risk translates into steeper premiums that can make your wallet feel a whole lot lighter.

Sales Tax Adds Up

When you buy a new car, you’re likely to face higher sales tax than you would on a used vehicle. This extra expense can add thousands of dollars to the overall cost, making it less appealing for many. In a lot of cases, buying pre-owned instead helps you avoid this financial hit.

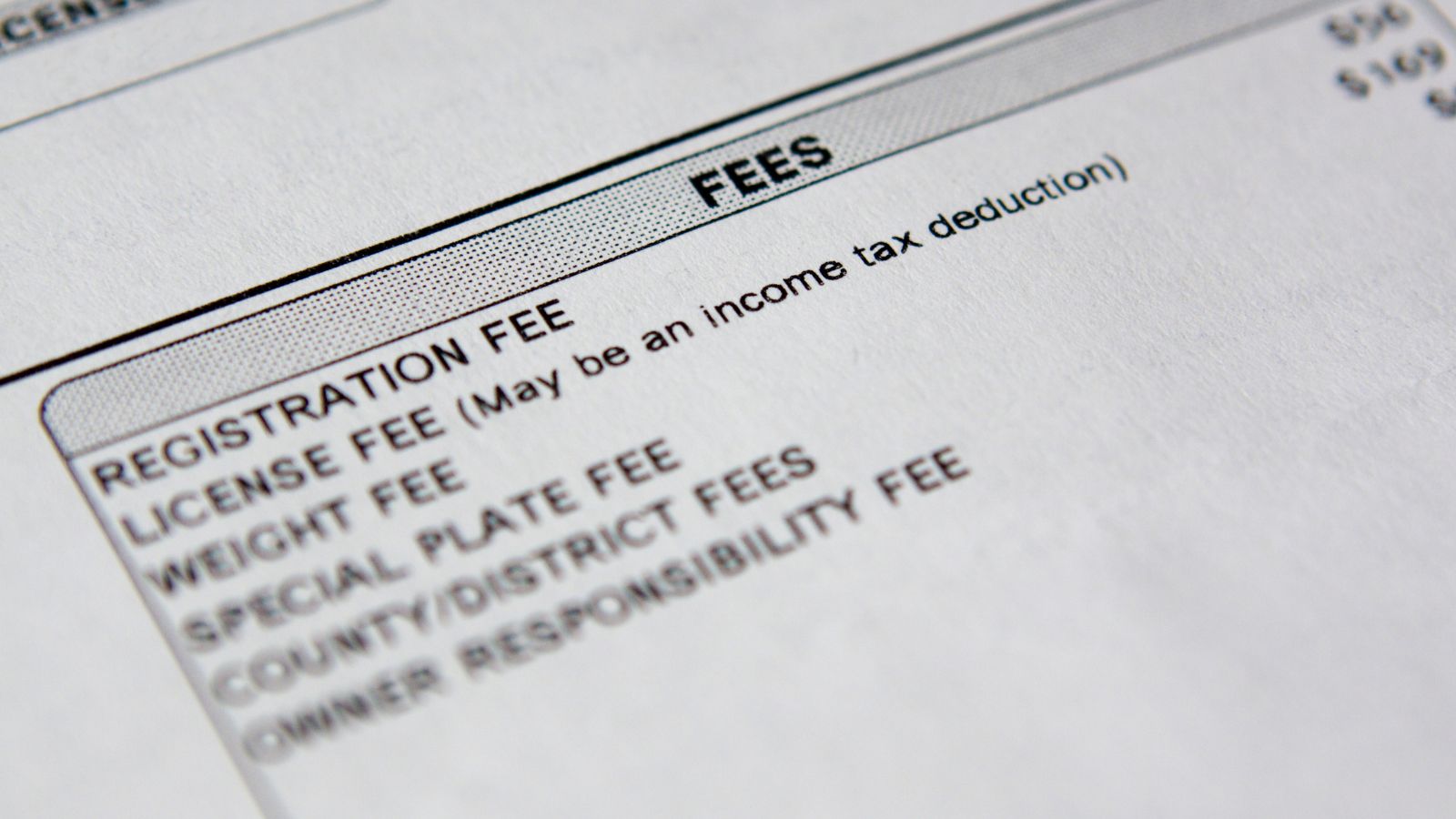

Costly Registration Fees

As you may know, in most states, car registration fees are based on the vehicle’s value. Since new cars are generally worth more than older ones, their registration costs can be significantly higher. Over several years, these fees can really add up, making a used car a better choice for anyone looking to save a lot of money.

Limited Customization Options

Sure, new cars do come with flashy trim packages and advanced features, but they might not offer the same level of flexibility you get when buying a pre-owned vehicle. Used cars often come with attractive after-market upgrades or modifications that can save you money on extras you might otherwise pay for at the dealership.

Better Deals on Certified Pre-Owned Cars

Certified pre-owned (CPO) vehicles often come with manufacturer-backed warranties and thorough inspections, offering a nearly new experience at a fraction of the cost. Many people find these cars to be a smarter, more economical option.

The Pressure of Upselling

You may have noticed that car dealerships often push extras like extended warranties, paint protection, or maintenance packages when you’re buying new. While these add-ons can be a nice touch, they also inflate the cost of your purchase and aren’t always necessary. If you go for a used car instead, it can help you avoid some of this upselling pressure.

Advanced Features Can Be Overkill

Don’t be fooled by all the fancy features and extras packed into modern cars. It’s great to enjoy the latest cutting-edge technology, but not all features are truly necessary.

Posh infotainment systems or self-driving capabilities may sound appealing, but they often come at a big price. A lot of buyers feel good about their decision in the moment but realize later that they don’t use half the tech they paid for.

Environmental Impact of Manufacturing

New cars are typically more fuel-efficient, but the process of manufacturing them has a significant environmental impact. If you want to make the best choice for the environment, buying a used car reduces the demand for production and helps lower your carbon footprint.

Repair Costs Aren’t Always Higher for Used Cars

Contrary to what many people think, newer cars aren’t always cheaper to maintain. While they come with nice warranties, the cost of fixing advanced features can be steep once the warranty expires. Used cars often have simpler systems that make repairs cheaper and more manageable.

Dependent on Incentives to Seem Affordable

I know that dealerships can be pretty convincing with their offers of rebates, zero-interest financing, or trade-in bonuses that make new cars appear more budget-friendly. However, these incentives can sometimes mask the true cost of the vehicle you’re buying. Without the incentives, the price might not be worth the long-term financial commitment.

Depreciation Even Hurts Trade-In Value

Believe it or not, if you plan to trade in your new car after just a few years, you’ll likely get much less than you paid. The rapid depreciation means you’ll lose a significant portion of your investment, making it even harder to afford your next vehicle.

Used Cars Hold Their Value Better

Since used cars have already gone through their steepest value drop, they’ll hold their value a lot better over time. This means that if you decide to sell or trade in a used car after a few years, you’re likely to lose less money compared to a new vehicle.

New Doesn’t Always Mean Reliable

If you think new means reliable and old means the opposite, it’s time to reconsider. While new cars often come with warranties, they can still experience recalls or significant issues with new technology. While it’s hard to believe, a used car with a proven track record of reliability can sometimes be a safer bet than a fancy new vehicle, especially if it’s a model known for durability.

It’s Not Always the Best Financial Priority

For a lot of Americans, a new car sadly represents a big chunk of their income or savings. If buying new means you’ll be stretching your finances too thin, it might not be the wisest decision. On the other hand, used cars allow you to allocate money toward more important priorities, like paying off debt or saving for a home.