Life is expensive; let’s face it. But just last week, major retailers like Target, Walmart, and other big stores stated they were lowering prices in response to consumer demand. While we hope other stores follow suit, there are still many things in our daily lives with consistently rising prices. Here’s a list of 17 things the average American just can’t afford.

Retirement

The golden years aren’t so golden anymore. The dream of a relaxing retirement is fading for many as rising costs outpace savings. Older people are finding the financial hurdles are stacking up, leaving many seniors wondering if they’ll ever be able to afford to stop working.

Dental Care

A report from USA Today explains that “the deficit in dental coverage is immense: Nearly 69 million U.S. adults did not have dental insurance or access to routine oral health.” Dental care is another escalating expense that’s making it less and less attainable.

Living Debt-Free

It has become increasingly challenging to live debt-free. Stagnant wages and the rising cost of living make it tough to make ends meet, let alone save for the future. And with tempting credit offers constantly flooding our inboxes, it’s easy to fall into the trap of borrowing.

Contingency Fund

Having a financial safety net for unexpected expenses is not a luxury most can afford. For many, paychecks barely cover the essentials, leaving little left over for savings, let alone a substantial contingency fund. When struggling to make ends meet, it’s easy to lose sight of the importance of saving for a rainy day.

Child Daycare

Fortune states, “Child care now costs more than housing in all 50 states.” This is a soaring cost that most people just can’t keep up with. Trying to juggle a job while finding qualified and trustworthy childcare is a real modern-day challenge.

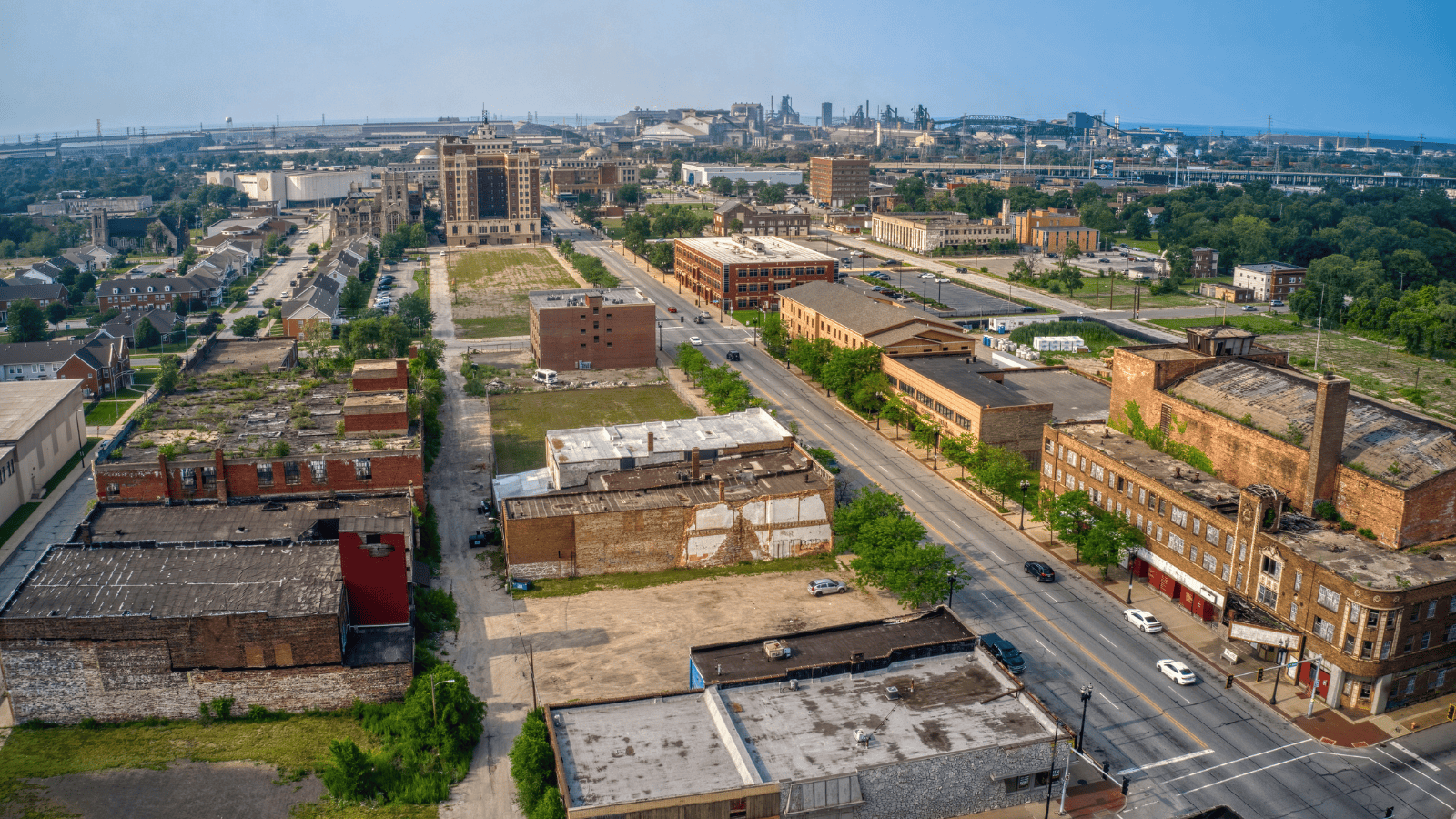

Home

Dreams of white picket fences are being dashed nationwide as the reality of being a homeowner slips further out of reach. Soaring house prices, stagnant wages, and skyrocketing rents have created a perfect storm, making it increasingly difficult for aspiring homeowners to get their foot in the door.

Concerts

Soaring ticket prices are making concerts an extravagance many can no longer afford. In addition, many have to shell out for expensive parking and over-priced food and drinks. With the majority of crowds now on their phones anyway, the opinion on experiencing a concert live seems to be shifting.

Pets

Forbes says, “While the love of a pet is priceless, the cost of owning one is not.” From pricey vet bills and prescription medications to the rising cost of food and supplies, having a pet is a luxury many can no longer afford. A surge in animal shelter numbers sadly reflects this struggle.

Vacations

The days of carefree getaways are fading as the cost of travel skyrockets. From soaring airfare and hotel rates to inflated prices for activities and dining, planning a vacation has become a financial burden that most can no longer bear.

Unpaid Sick Days

Unpaid sick days are a luxury many can no longer afford, forcing a difficult choice between health and financial security. For those living paycheck to paycheck, missing work due to illness can lead to missed bill payments, mounting debt, and even eviction. This creates a vicious cycle of financial and physical strain.

Kids

The pitter-patter of little feet is becoming a distant dream for more people, with the costs of raising a child becoming out of people’s means. From soaring childcare costs and education expenses to the everyday essentials like food and clothing, having kids is a financial burden that a growing number of families cannot sustain.

New Car

The NIADA reveals how “used vehicle sales [are] expected to increase in 2024” as owning a new vehicle becomes a financial fantasy for many. Soaring sticker prices, coupled with rising interest rates and insurance premiums, are making buying a new car a distant aspiration for most.

Impulse Buys

The thrill of impulse buys is fading as people continue to tighten their purse strings. The once-common “treat yourself” mentality is becoming a thing of the past as financial pressures mount. For many, spontaneous purchases are now a guilt-ridden indulgence that’s simply not in the budget.

College Education

Tuition hikes, extortionate textbook prices, and campus fees are making a college degree a luxury that’s increasingly out of reach. Getting a degree at a private or out-of-state college will cost even more than at an in-state public college. Students often need to take out loans to cover it all, which isn’t an option for everyone.

Eating Out

Dining out was once a regular treat, but now it is a rare indulgence for many. A hike in menu prices, driven by increased food and labor costs, is making people eat out less. For many, the joy of exploring new cuisines or enjoying a night out is now replaced by home-cooked meals and budget-friendly takeout options.

New Phone

With prices climbing into the thousands for top-tier models, upgrading to the newest iPhone or Android device can no longer be justified for those struggling with the cost of living these days. The choice comes down to a hefty phone bill or other essential expenses.

Weddings

It seems like to get married these days, you need to remortgage the house to be able to afford it. While weddings were always expensive, they were, at least once, fairly affordable. Nowadays, everyone is cashing in on your big day, charging premium prices for the same service just because you are getting married!

Up Next: 17 Places in the U.S. Where Even Truck Drivers Won’t Stop

Truck drivers tend to be hardy souls—well-seasoned travelers who aren’t often afraid to rest up or refuel in risky locations. However, there are certain U.S. locations that even the most road-weary trucker refuses to stop at for fear of criminal activity or natural dangers. Here are 17 such locations that even experienced truck drivers approach with trepidation (or not at all).

17 PLACES IN THE U.S. WHERE EVEN TRUCK DRIVERS WON’T STOP

17 Things Guests Actually Notice Right Away About Your House

Inviting people into your home is a big deal. You may be very house-proud or house-conscious, and if you are either, you’ll likely get anxious about hosting. If this sounds like you, stop worrying and focus on the following 17 things that guests actually notice right away about your house.

17 THINGS GUESTS ACTUALLY NOTICE RIGHT AWAY ABOUT YOUR HOUSE

The 17 Unhappiest States in America

The US has hit an all-time low position in the World Happiness Index, tumbling to 23rd in 2024. However, it’s important to remember that location is an important factor; many US states are very happy, unlike the following 17 US states that appear to be the most unhappy.