Millennials often find themselves in a tight spot when it comes to their finances due to a combination of factors, generally unique to this generation. Read on to understand 17 of the key reasons that America’s biggest generation to date has had such struggles when it comes to money.

Stagnant Wages

According to the Pew Research Center, “today’s real average wage (that is, the wage after accounting for inflation) has about the same purchasing power it did 40 years ago.” This means that for many, wages haven’t kept up with the rising cost of living.

Changing Job Market

Due to the high cost of living, many millennials have turned their hands to side hustles or extra part-time work. This is known as the gig economy, but unfortunately, these jobs rarely offer any security, which means people miss out on benefits such as health insurance or retirement plans.

Increased Health Care Costs

Over the last decades, healthcare costs have risen significantly, with the cost of insurance premiums and upfront expenses both increasing. As a result, many millennials are avoiding treatments or care that they need, leading to higher costs down the line as their symptoms or conditions worsen.

High Cost of Education

The cost of college education has risen significantly over the last decades, putting young people into debt before they’ve even entered the workplace. LendingTree says that between the time that this generation was born and the time that they enrolled in college, “tuition rose 213% to today’s cost of $9,970 per year.”

Delaying Milestones

This generation is getting married, buying homes, and having children later than the generations before them, and this is partly due to the financial struggles they are facing. While it may be helpful to delay them now, many say that these delays will harm their long-term financial futures.

High Lifestyle Costs

Millennials were the generation that created social media and grew it into the beast it is today. The constant comparison that comes from sharing our lives in this way means they have more impulsive spending habits, especially when it comes to consumer goods.

Credit Card Debt

Frequently used to help bridge gaps in their monthly income, many millennials are finding themselves with high levels of credit card debt. High interest rates often make it difficult to pay off the debt, and this has a negative impact on their credit scores. CNBC found that the average millennial has $4,322 in credit card debt.

Impact of the Financial Crisis

A lot of millennials entered the workforce during, or shortly after, the 2008 economic crisis. Since then, they have struggled with lower earning potential and less opportunity for career growth. They are also less likely to benefit from as many investments because many avoided taking risks with their earnings at the time.

Lack of Financial Knowledge

There’s a big gap in the financial education of millennials, meaning they are less able to make well-informed financial decisions. As a result, they’re more likely to make poor investments, not save as much, and get themselves into bigger debt than other generations.

Not as Prepared for Retirement

Pension plans of the past are now very rare, and most millennials have to rely on defined contribution plans. These require more hands-on management and are less likely to pay out a good income in retirement. On top of this, the high cost of living and poor earnings make saving for retirement a challenge.

Big Debts

On average, millennials who have degrees or further education qualifications have around $30,000 in student loan debt. This has a significant impact on their financial decisions and quality of life, often meaning they delay saving or making investments in order to pay the debt off.

Limited Savings

Generally, millennials save less each month compared to previous generations, and many live paycheck to paycheck. This is caused by a challenging combination of high student loan and credit card debts, lower wages, and higher living costs. Not only does this mean they’re less financially secure, but they also don’t benefit from investment income.

Rising Housing Costs

Home prices and rents have risen faster than wages for this generation, particularly in urban areas. For many, this means they are unable to buy their first home. Despite this, Fortune says that millennials account for “60% of homes bought with mortgages over the last few years.”

Increased Childcare Costs

Childcare costs have also risen over the last few years and often make up a significant portion of the family budget. In some regions, the cost of childcare is higher than the cost of housing. This means millennials have a difficult decision to make about whether or not they go back to work, impacting their career progression and lifestyle.

Influence of Technology

Technology has impacted the lives of millennials in pretty much every way, including their finances. While banking apps give them visibility on spending and budgeting, there are also drawbacks to the digital world, including online shopping, which leads to more impulse spending.

Economic Inequality

The gap between the richest and poorest in society has widened in recent times, meaning a lot of millennials are struggling to reach their long-term financial goals. They’re also less likely to benefit from inheritance or family support that may have given them a jumpstart in investments.

Global Job Market

As travel and remote working are more accessible than ever before, there is much more competition for high-paying jobs. The global job market also means that wages are pushed down and workers have less job security as there’s a larger pool of qualified candidates for each position.

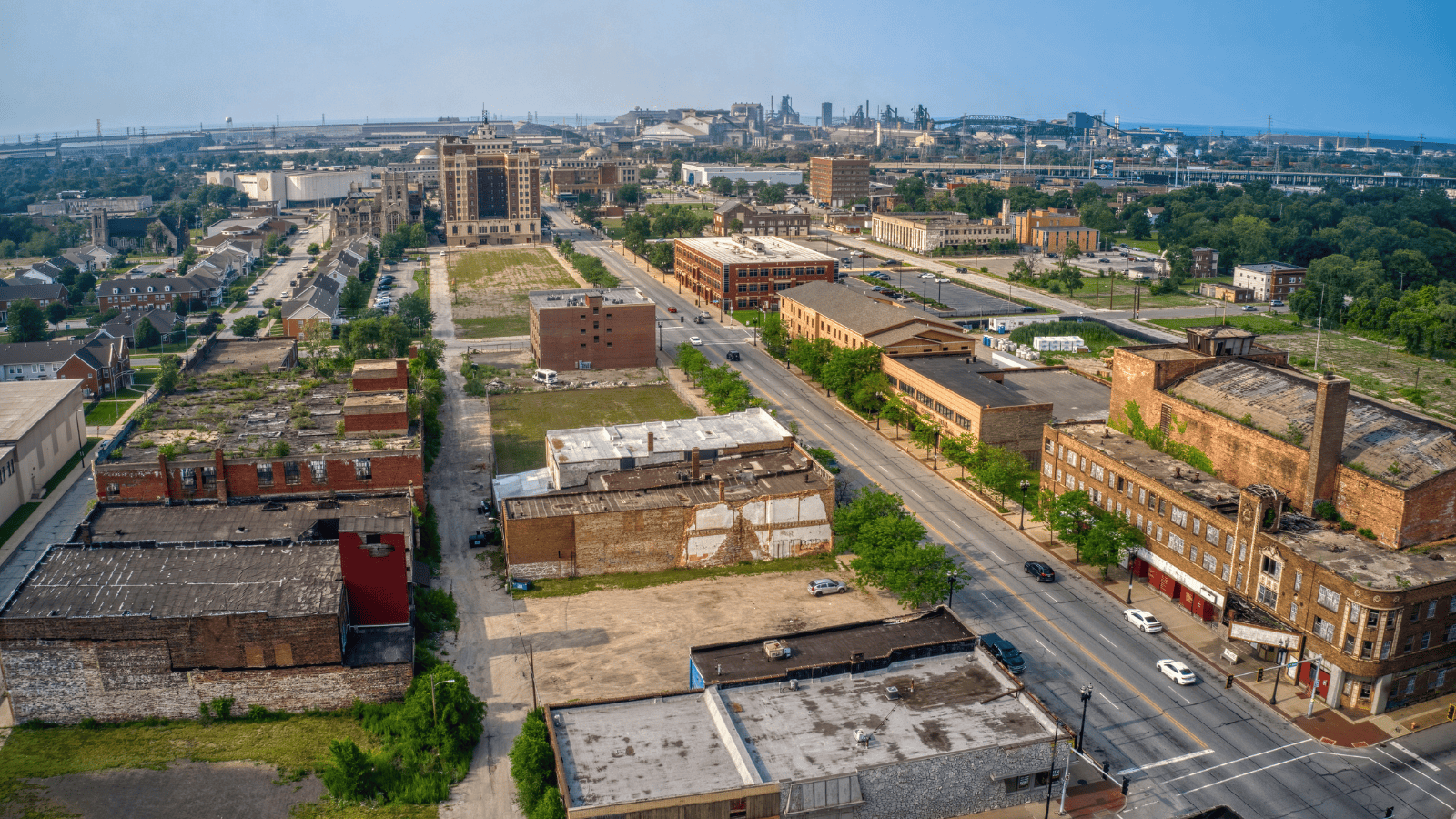

Up Next: 17 Places in the U.S. Where Even Truck Drivers Won’t Stop

Truck drivers tend to be hardy souls—well-seasoned travelers who aren’t often afraid to rest up or refuel in risky locations. However, there are certain U.S. locations that even the most road-weary trucker refuses to stop at for fear of criminal activity or natural dangers. Here are 17 such locations that even experienced truck drivers approach with trepidation (or not at all).

17 PLACES IN THE U.S. WHERE EVEN TRUCK DRIVERS WON’T STOP

17 Things Guests Actually Notice Right Away About Your House

Inviting people into your home is a big deal. You may be very house-proud or house-conscious, and if you are either, you’ll likely get anxious about hosting. If this sounds like you, stop worrying and focus on the following 17 things that guests actually notice right away about your house.

17 THINGS GUESTS ACTUALLY NOTICE RIGHT AWAY ABOUT YOUR HOUSE

The 17 Unhappiest States in America

The US has hit an all-time low position in the World Happiness Index, tumbling to 23rd in 2024. However, it’s important to remember that location is an important factor; many US states are very happy, unlike the following 17 US states that appear to be the most unhappy.